DDGS prices drop following crop report

April 16, 2013

BY Sean Broderick

Advertisement

Advertisement

Related Stories

The ethanol and ethanol co-product industry continues to be a main economic driver in Nebraska, producing near-historic averages in 2020, despite lower ethanol prices and COVID-related production issues, according to a new study.

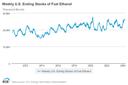

U.S. fuel ethanol production fell by nearly 2% the week ending April 5, according to data released by the U.S. Energy Information Administration on April 10. Ethanol stocks were down nearly 1% and exports expanded by 120%.

Colonial Oil Industries Inc. will pay a $2.8 million civil penalty and purchase and retire 9 million RINs at an estimated price of $12.2 million under a settlement agreement reached with the EPA and Justice Department related to CAA violations.

Tallgrass, the developer of a CO2 pipeline project that will sequester CO2 sourced from ethanol plants and other facilities, has entered a Community Benefits Agreement with Bold Alliance. The CBA is endorsed by several ag and biofuel groups.

The Renewable Fuels Association, U.S. Grains Council and Growth Energy in April jointly submitted comments within the Brazilian Chamber of Foreign Trade (CAMEX) regarding the Brazilian tariff on imported U.S. ethanol.